For those of you who missed today’s lecture (June 10, 2011), the following summary will have to do.

Is Karl Marx still relevant?

I am guessing that for most readers, the answer to this question is almost too obvious to even bother asking. Beyond a minuscule gaggle of new and old Trots, of course Karl Marx is not relevant. The US won the Cold War. End of story. So, why are we even asking?

Nor does it help if we spruce up the question: Why is Karl Marx no longer relevant to practicing economists? Because, again, the answer seems all too obvious. Karl Marx is no longer relevant to practicing economists because they presume as a given what Marx, the archetypal critic of capitalism, called into question.

So, rather than asking why practicing economists no longer believe Marx is relevant, perhaps we should be asking why they take capitalism as a given. Here the answer may seem straightforward. But its not. For, as anyone who has taken an introductory course in economic theory knows, what we accept as given was hardly so when our field was trying to define itself in the eighteenth century. That is because eighteenth century political economists knew not only that what they were doing was quite novel. They also knew that the world they were doing it in differed qualitatively from every other world in the past. These original political economists, these “worldly philosophers” as Heilbroner calls them, knew therefore that nothing, but nothing, could be taken for granted. Which is why, one after another, these worldly philosophers wrote chapter after chapter showing why this novelty was, in fact, necessary, right, and natural.

Take Adam Smith, for example. Based upon not the least shred of evidence, Smith trotted out what appeared to be a fairly plausible explanation for the emergence of markets and market behavior. We have, so Smith argued, a “natural propensity to truck, barter, and exchange.” But then why was Smith compelled to devote so much ink to showing why and how civilization after civilization failed to take full advantage of this natural propensity. In fact, though Smith could not have known it at the time, most human beings would spend 2.49 million years avoiding settled communities, wandering from one hunting or gleaning ground to another, steering clear of one another, before, over time markets began to emerge. It would, however, be several millennia before markets would become the dominant and, then, universal determinant of social life.

Nevertheless, the fact is that these classical economists felt compelled to engage in historical reflection, to explain themselves, their world, and to naturalize the unnatural and unprecedented way of life that was emerging. They could not simply out and admit, “Hey guys, we’re making it up as we go along.” Instead they had to try to make the connection between the novelty of the emerging capitalist world and what human beings had always been or had always been predisposed to be (but for the obstacles placed in their path by family, clan, tradition, religion, superstition, and the like). Human beings had always been made for trucking, bartering, and exchanging. And, so, against all evidence, these worldly philosophers set to work showing how this had to be so.

So, how was it that economists began to shed their interest in the historical and social foundations for their young profession? Although scholars still argue over the specific events that brought economists to turn their backs on history and society, there is broad agreement over the logic that justified their move. And, even two centuries later, the elegance of this logic has to be admired.

The two axioms of economic rationality

For, ask yourself: what is it that makes human beings human? It is, you say, freedom. Well, then, what is it that makes primitive peoples primitive? What makes primitive peoples primitive is their lack of freedom. Fair enough.

But, what is freedom? For centuries, in every community and civilization around the globe, freedom had been understood as the conditions that make for freedom. Freedom is the consequence of obeying the commandments of God, observing the proper rituals, honoring the leader chosen by the gods, following the advice of the local shaman, eating the sacred roots, honoring my elders, remembering the stories that have been told forever, and so on. In every community, wherever we look, prior to the fifteenth century freedom is understood as the conditions that make for freedom.

But, does this understanding of freedom make sense? How can freedom be conditioned? Isn’t that the very definition of an oxymoron?

And, so, classical political economists came up with an alternative definition. Freedom, they said, is the absence of constraint. But, note what this definition of freedom does to all traditional communities and their understanding of freedom. All of a sudden, their very notion of freedom has been transformed into its very opposite. And what they took to be the conditions that make for freedom actually turn out to be the constraints that make for bondage.

More importantly, this new understanding of freedom suggests that the new way of life that had begun to dominate Europe, a life of trucking, bartering, and exchanging, was not so new after all. Indeed, it was as old as humanity itself. For, what else was humanity if not those beings who by nature are free?

This, then, was the first axiom of the new science. The second one was equally important: all things in nature, by definition, are constrained. Of course, this axiom provided the foundation for all of the new natural scientific disciplines. For, by definition, any natural scientific explanation that sought to introduce freedom as a condition cannot help but fail.

Armed with these two axioms—freedom is the absence of constraint, natural scientific explanation is devoid of freedom—the new discipline of political economy could move forward. Or could it? For the question remained: was economics a science (in which case it could not allow freedom to enter into its calculations) or was it, like History or Philosophy or Theology, a branch of moral philosophy?

To answer this question, the new economists found their new definition of freedom extremely helpful. For, it turned out, there was nothing to prevent these new scientists of economic behavior from measuring, calculating, and formalizing this behavior without ever touching upon the whole question of freedom, which, of course, remained beyond calculation.

History, which looks at the conditions that make for human life, need never enter into the discussion. And, so, economics could become that unique social science in which the social and the historical play no visible role.

Hegel’s Objection

Of course, not all of the worldly philosophers were equally pleased with this solution. When economists bracketed history and society did they not at the same time bracket all that was most interesting and worth exploring in human beings? What about religion, art, dance, poetry, literature, culture, and so on?

Needless to say, eventually, economists would find a way to reduce all of these human activities to numbers, points, and lines on their graphs and regression tables. But, at least initially, the twin axioms covering freedom and science drove a wedge between those disciplines that explored the world of historical change and difference, on the one hand, and those that explored the immutable world of scientific cause and effect on the other.

But, how could these two worlds really exist side by side? Are there really two worlds and not one?

Of all the worldly philosophers, none perhaps was more troubled by these questions than was Georg Friedrich Wilhelm Hegel. Where Hegel’s colleagues were perfectly happy to abandon history and society to the less than fully scientific instruments of their less than fully scientific colleagues in the humanities, Hegel did not share their glee. No amount of mental gymnastics could free humanity, human history, or human society from the fact that even our highest thoughts are clothed in and shaped by the worlds in which human beings and human communities remain embedded. Freedom is conditioned.

But, here is where things get interesting. Even if we accept Hegel’s objection, even if we reject the binary world of the classical political economists, it is still possible that the world itself, or at least the world of western Europe, was increasingly assuming a shape that lent itself to the kinds of mathematical tools and models championed by these economists. Let us suppose, for example, that things like family, clan, religion, and guilds were becoming less and less important forces shaping people’s lives. Let us further suppose that economic markets and relationships of pure economic exchange were exercising ever greater influence over people’s day-to-day decision-making. Might it not then follow that the tools and models championed by the new economists actually had greater explanatory power than the old models built on the hunches and guess-work of historians, philologists, and philosophers?

Indeed, it might. But, by restating the problem in this way, it is now clear that this new way of thinking about the world, as well as the new world that lends itself to such thinking, are not by any stretch of the imagination “natural” or “given.” To the contrary, they are as much the products of history and change as any other social formation that scholars might study.

Enter Karl Marx, the Hegelian

Karl Marx was an Hegelian. At the very least, this means that, along with Hegel, Marx could did not accept the classical political economists’ understanding of freedom as the absence of constraint. So, although Marx would come to disagree vehemently with Hegel over a wide variety of things, at least where freedom is concerned Marx was an Hegelian. Freedom needs to be understood as the conditions that make for freedom. And this, by itself, would have been sufficient to explain why Marx is irrelevant to practicing economists.

In other respects, however, Marx was (at least initially) much influenced by the classical economists. Thus, for example, although we often mistakenly identify the so-called “labor theory of value” as a principle of Marxism, it was, in fact, a leading principle of mainstream classical political economy. Consider, for example, the justly famous opening paragraph to Adam Smith’s Wealth of Nations, Chapter Five:

Every man is rich or poor according to the degree in which he can afford to enjoy the necessaries, conveniencies, and amusements of human life. But after the division of labour has once thoroughly taken place, it is but a very small part of these with which a man’s own labour can supply him. The far greater part of them he must derive from the labour of other people, and he must be rich or poor according to the quantity of that labour which he can command, or which he can afford to purchase. The value of any commodity, therefore, to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities. (Emphasis added).

When Marx adopted the “labor theory of value,” he was simply embracing what other political economists accepted as a given.

Similarly, even when the early Marx called attention to the fact that this value had been “alienated” from its producers, he was really saying nothing that other political economists had not said before him. The truth is, as Professor DeLong has already noted, there was not a great deal in the early Marx to distinguish his theories from the theories of his colleagues. So it is entirely un-noteworthy that both left-wing Hegelians and French socialists had long called upon labor to “reclaim” the “value” that had originally been alienated from them.

Even the very heart of the early Marx’s theory—the contradiction that, according to the early Marx, lends capitalism its peculiar directional dynamic—is not particularly noteworthy. Here the socialized forces of production (epitomized by and embodied in the industrial working class) are said to stand in tension with the private relations of production (epitomized by and embodied in the bourgeoisie’s private ownership of the means of production). This contradiction, however, was only the latest and “most advanced” iteration of a “dialectic” that had been at play since the beginning of human history; a history which was itself nothing more than the “history of class conflict.”

But peel back the surface of this dialectic and Marx’s theory is fairly mundane. It says, in effect, that labor produces all value, that the bourgeoisie have stolen this value, and that labor should take it back. Once labor does take it back, history will end because the socialized creators of all value will be the socialized owners of all value. End of dialectic. End of History.

Except for the “taking back” part, there is nothing particularly revolutionary about Marx’s theory. What is more, it wasn’t particularly historical either. And Marx knew it.

Karl Marx’s Mature Social Theory

Which is why, beginning in the late 1850s, Marx began to rethink his overall theory. The problem, as Marx saw it, was that his original theory was hopelessly anachronistic. Instead of setting out to explain how an unprecedented system like capitalism could have arisen, historically, he had, in effect, gone to the same well and even used the same pail as the classical political economists. That is to say, rather than seeking an historical explanation for capitalism, Marx had taken capitalism as a given and then had interpreted all of previous history in the light of that given. Had history, in fact, been the history of class struggle? Of course not. And Marx knew it.

So, in the late 1850s Marx began to set out an alternative explanation for capitalism. As evidence of this new approach, Marx elected not to begin his magisterial Das Kapital, as he might have, with a fanciful account of the history of class struggle, but, rather, reflecting his new understanding, with a lengthy, if somewhat pedantic, explanation of what he called the “commodity form.”

This new approach reflected Marx’s dramatically reworked explanation for the central contradiction in capitalism. The problem with the old approach was that its concept of freedom was all wrong. How, in any stretch of the imagination, could the universalization of labor be deemed emancipatory? Were the value created by labor restored to labor, that would in no way free labor from the form of domination under which it was laboring.

What is more, the contradiction between social forces and private relations of production failed to accurately reflect how capitalism actually worked. Instead, according to Marx’s new explanation, the social logic embedded in capitalism moved in an entirely different direction. This social logic revealed a contradiction not between social forces and private relations, but, rather, between material wealth and immaterial value. Thus, Marx’s new focus on the commodity form, a combination of material wealth and immaterial value.

But, how did Marx feel that this contradiction worked? According to Marx, in a competitive market, capitalists are preoccupied with producing ever greater immaterial value with ever fewer material inputs. In other words, they are preoccupied with what we would call productivity. But to achieve this productivity, they must always be searching for means to lower their costs: reducing the cost or volume of labor, finding cheaper sources for the means of production, cheaper raw materials or basic capital goods, cheaper transportation, additional markets, more effective and efficient mechanization. In a competitive market, this drive toward ever greater efficiency led to continuous, ongoing, unceasing industrial revolution.

For Marx, this also helped to explain why non-capitalist social formations appeared to be going nowhere. Social relations in these societies are mediated by a variety of different value spheres: family, religion, craft and trade guilds. And because these different value spheres bear no necessary logical relationship to one another, they are incapable of generating a dialectical directional dynamic. Rather, in non-capitalist societies, these relationships have always to be either practically or discursively negotiated.

In capitalist societies, by contrast, all social relations and all social value had come to be mediated by abstract labor time expended. What this means is that all dimensions of social life can actually be reduced to price, cost, time, interest, and value. In other words, all dimensions of life are linked to one another in ways that can be calculated and charted, mapped and formulated, logically and even mathematically.

But—and here’s the rub—as all capitalists busy themselves producing ever greater material wealth at ever decreasing labor costs, this universal compulsion cannot help but lead to a contradiction between labor and material wealth. Put differently, the more efficient capital becomes, the less labor it requires, the more cheaply it can produce material wealth. But, since the value of material wealth is linked to labor, this also means that the per unit value of this ever growing volume of material wealth is simultaneously declining.

Traditional Marxists have described this increasing tension between material wealth and labor in a variety of ways, either as a crisis of overproduction or a crisis of underconsumption, or both. And, building upon Marx’s early theory, traditional Marxists have a ready solution. If only the production and distribution of goods was better coordinated by the socialized workers, we would never face these periodic crises.

The mature Marx had a radically different take. In his view, these periodic crises showed that the production of material wealth was, in fact, growing increasingly independent from abstract labor time expended. Thus, one of the cornerstones both of classical political economy and traditional Marxism was now up for grabs. If material wealth was no longer dependent on abstract labor time expended—i.e., on abstract value—then this growing independence might point the way to human emancipation from the sphere of production per se.

But, now, instead of thinking about this emancipation in terms of restoring to labor the value that capital had stolen from labor—i.e., labor reclaiming its alienated labor time, labor “returning to itself”—Marx began to think about emancipation in terms of the end of labor.

Needless to say, this new way of thinking about emancipation created huge problems for Marx. For, on the one hand, the very notion of a working class movement was based on industrial production and the kind of working class solidarity that is forged on the shop floor and in the political organizations that represent working class interests. If, on the other hand, the very logic of capitalism entailed a gradual liberation of workers from the production process, then this clearly could deprive the labor movement of one of its most powerful weapons in the class struggle. And, yet, if Marx’s new understanding was correct, then did it not call into question the very notion of a class struggle itself.

As evidence of this new understanding, consider this tortured paragraph from volume three of Das Kapital:

In fact, the realm of freedom actually begins only where labour which is determined by necessity and mundane considerations ceases; thus in the very nature of things it lies beyond the sphere of actual material production. Just as the savage must wrestle with Nature to satisfy his wants, to maintain and reproduce life, so must civilized man, and he must do so in all social formations and under all possible modes of production. With his development this realm of physical necessity expands as a result of his wants; but, at the same time, the forces of production which satisfy these,wants also increase. Freedom in this field can only consist in socialized man, the associated producers, rationally regulating their interchange with Nature, bringing it under their common control instead of being ruled by it as by the blind forces of Nature and achieving this with the least expenditure of energy and under conditions most favourable to, and worthy of, their human nature. But it nonetheless still remains a realm of necessity. Beyond it begins that development of human energy which is an end in itself, the true realm of freedom, which, however, can blossom forth only with the realm of necessity as its basis. The shortening of the working day is its basic prerequisite.

There is surely much to criticize in this passage, from Marx’s characterization of savages to his naïve portrayal of “socialized man, the associated producers,” to his perhaps overly optimistic faith in our ability to rationally regulate our relationship with nature. And, yet, these concerns are overshadowed by the overall direction of the passage.

Marx is not claiming that human beings could (or should) free themselves from their relationship with nature. The realm of necessity persists in all forms of society. And, yet, he is claiming that human beings might steadily reduce the control that these “blind forces” have over them, among which Marx counts “labour.” Why? So that they can cultivate those dimensions of their “human nature” that are not dictated by necessity, of course. In other words, Marx no longer considers labour to be among those activities “favorable to” and “worthy” of “human nature.” Marx is not suggesting that human activity would cease, but that it would shift, away from the “labour” that we must perform in order to satisfy “the realm of physical necessity” to activities that we would perform as free individuals.

But, if labor no longer mediates social relations, then what could possibly take its place? In this iteration, Marx could not have been clearer. “Socialized” human beings would regulate their relationships with one another and with nature “rationally.” They would think and they would talk.

Yet, even this dramatic shift in perspective pales when we consider how Marx felt this revolution would be achieved. It would be achieved, writes Marx, by “the shortening of the working day.” Our initial response to Marx’s proposal might be, “Yes, but how is this revolutionary?” Through its own internal logic, capital is already predisposed to reducing the role that labor plays in production. And, indeed, over the past two centuries, have we not already observed a natural shortening of the working day, from twelve hours to ten, from ten to eight, and, in some places, from eight to five? Not to mention the elimination of Sundays and then Saturdays from the working week and the seemingly unending piling up of holidays, sick leave, maternity leave, paternity leave, and family leave. So, how is the shortening of the working day in any way revolutionary?

It is revolutionary because, although capital proves itself to be ever more productive over time, this productively does not translate naturally into the shortening of the working day. To the contrary, May Day itself, that beacon of international labor, commemorates the massacre of workers in Chicago’s Haymarket who had gone on strike for nothing more radical than precisely the shortening of the work day. For, even though its own internal logic creates an increasingly broad gap between material wealth and abstract labor time expended, capital would just as soon translate this broad gap into ever greater volume of commodities or lower prices for these commodities as translate it into an ever shorter working day.

And is this not precisely the direction that capital in fact took over the next century and a half?

Marx’s Mature Social Theory and the Contemporary Economy

Consider, for example, the Great Crash in 1929 and the subsequent Great Depression. Traditional Marxists have interpreted the Great Crash as a classic case of overproduction and/or underconsumption. This, they argue, is precisely what we can expect when capital accumulation is not deliberately, self-consciously, and socially coordinated with labor. Capital produces more wealth than demand can satisfy. The solution, according to traditional Marxists, is the planned economy.

Yet, if we interpret the Great Crash in light of Marx’s mature social theory, we get a completely different story. Never had capital been more productive than it was in the late 1920s; more material wealth was now being created with fewer per unit labor inputs than ever before. This productivity showed, beyond a shadow of a doubt, that wealth could be produced with far less labor time expended, clearly suggesting the possibility of a far shorter work day and work week. And, yet, because capital continued to quantify the value of its output in units of abstract labor time expended, capital could not sustain these high levels of material production alongside ever decreasing labor inputs. At some point, investors would realize that there was insufficient labor time to underwrite the value ascribed to this volume of material wealth. And, when investors made that realization, they would act accordingly: Sell!

The British economist John Maynard Keynes’ interpretation of the crisis was spot-on. Capital had never been so productive than it was in the 1920s. It was creating wealth hand-over-fist. But, since there was insufficient labor time to consume that wealth, this meant either that its value would have to retreat to the level of actual labor time expended or that the value necessary to underwrite this wealth would have to come from somewhere else. In the end, the public elected to deliberately, self-consciously, and socially recalibrate the volume of wealth that capital could produce with the volume of labor necessary to consume that wealth. In other words, it instituted something like the the solution recommended by the traditional Marxists. But—and this is the revolution—it adopted this solution because it recognized that the production of material wealth had grown increasingly independent from abstract labor time expended.

The social welfare state that emerged from this solution, first in Sweden and the United States, then in Great Britain and, following the war, in France and West Germany as well, would have received the hearty approval of the early Marx. This is because the social welfare state was, if nothing else, the return of the value labor had created, but which capital had appropriated, to labor itself—in the form of health care, education, housing, secure employment, secure retirement, vacation time, and so on.

How—or rather why—did capital so willingly buy into this arguably Marxian solution? There is obviously no single, satisfying answer to these questions. To be sure, the working class movement in the United States was growing increasingly militant in the 1930s and 40s. So, too, capital could see where it too would benefit from more active public, social, coordination of wealth and labor. But, even more decisive was the simple fact that in order to wage and win its war against Germany, Japan, Spain, and Italy, the United States needed to ramp up its industrial production and direct that production toward specific goods. This publicly coordinated effort proved so successful, both for capital and for labor, that both quickly bought into at least the premise of the social welfare state. Add to this the fact that Europe’s and Japan’s industrial capacity had been devastated by the war, and you have the makings for the longest industrial boom of the twentieth century.

But, again, we need to bear in mind what precisely this means. It means that, in spite of rising labor costs, capital itself was far more productive than it had ever been before. It was producing ever more material wealth not only with decreasing abstract labor time expended, but also with increasing social costs to boot.

Of course, precisely because of the productivity of capital, it was only a matter of time before the gap between material wealth and abstract value would grow so large as to once again generate a crisis. What is more, by the mid-1960s both Japan’s and Germany’s economies had recovered sufficiently to join the global race to the bottom. That is to say, Japan and Germany too were creating more material wealth than could be backed by ever decreasing labor time expended. This dramatic increase in productivity, now on a global level, clearly could not be sustained.

Different nations have taken different paths in response to the now half-century old crisis in capital accumulation. In light of its experience with fascism, Europe has been reluctant to sacrifice social and political stability to the potentially insatiable appetite of unregulated capital. Europeans have therefore been more willing than either their Asian or their US counterparts to translate gains in productivity into shorter working days and the broadening of the social franchise (e.g., education, health, housing, pensions, parks, public support of the arts, and so on). Yet, because they are linked globally to other economies—chiefly the US and China—even Europe is having to consider other ways of addressing the growing gap between material wealth and abstract value.

Thus, for example, when the crisis of capital accumulation hit the US in the late 1960s and early 1970s, rather than translate the productivity of capital into shorter working days or a broader social franchise, the US instead, on the one hand, elected to reduce the value of its material wealth to the actual level of labor time expended, creating massive unemployment and inducing an actual reduction in production capacity in the process. And, on the other hand, to relieve the resulting costs these steps placed on capital, the US also loosened up credit, making it possible for capital to expand its debt both temporally (over time) and spatially (around the globe). China, which in 1989 became the lone remaining major communist nation, adopted a path not dissimilar for the United States. It too refused to translate gains in capital productivity to shorter working days or a broader social franchise. But, unlike the US, China did not exchange its productive capacity for debt. To the contrary, China instead made a point of purchasing the growing US debt.

In the end, however, it is likely that the pressure of the US, on the one hand, and China, on the other, will compel Europe to rethink its solution to the growing gap between material wealth and value.

Longer-term economic patterns

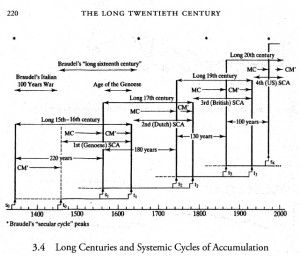

Giovanni Arrighi found nothing particularly unusual in this pattern of capital accumulation followed by crisis. Indeed, following a model suggested by Ferdinand Braudel, Arrighi found evidence of this same pattern all the way back to the fifteenth century. According to Arrighi, capital is attracted to certain specific conditions—predictable, stable laws of trade, secure production and markets, and a reasonable rate of return. Once any nation has proven itself able to secure such conditions, it, by definition, deserves the title “hegemon,” and is acknowledged as such by all of those nations that benefit from its hegemony. Yet, eventually, every hegemon inevitably undergoes a systemic crisis of capital accumulation, followed by a period of financialization and war.

Arrighi believed he could discern four such cycles of capital accumulation in history, each of successively shorter duration that its predecessor. The first, northern Italian, cycle took root in the early fifteenth century and by mid-century had already reached its maximum productive capacity. The very success of the northern Italian city states helped fuel the growth of western and northern Europe’s emerging powers, most notably Spain and Holland. Indeed, the conflict between Spain and Holland offered a more productive investment opportunity to northern Italian capital than did the continuing production of material wealth. So, at the very moment that northern Italian capital was financializing, Dutch investors were beginning to plow their capital into material production. When Spain and Holland went to war, northern Italian money wisely sided with the Dutch, thereby in fact hand-picking their own successor.

Arrighi found this same pattern repeated again and again, next in the rise of English hegemony and then in the rise of US hegemony. And in each case, Arrighi found parallels. When the Dutch reached their productive capacity and began to financialize, their investments ultimately secured the victory of England over France; and when in the nineteenth century the British reached their productive capacity and began to invest heavily in the US and Europe, they helped underwrite the industrial booms in Germany and the US. When Germany and the US went to war (1914-1945), the UK sided with the US, the successor hegemon. And when the US reached its industrial peak in the 1960s and sought to maintain and extend its gains through financialization, it inadvertently helped boost the industrial growth of China and other creditor nations, which, should Arrighi’s model hold true, would presumably go to war. Whichever block the US put its not inconsiderable weight behind would then emerge victorious as the next hegemon. Or (and Arrighi himself allowed for this possibility), the world’s nations would opt for effective economic regulation on a global scale.

Battling History

But, with this alternative, we find ourselves seated squarely back in the early Marx: that is, we end up overcoming the contradictions inherent in capitalism by coordinating material wealth and abstract value. Yet, if what we have said so far holds, then the re-coordination of wealth and value globally will not overcome the logic implicit within capitalism for the production of material wealth to shed its dependence on abstract labor time expended. And we are back with the mature Marx’s insistence that “freedom begins only where labor . . . ends” and therefore that “the shortening of the working day is its basic prerequisite.” In other words, what is required is not a mere adjustment or recalibration of the relationship between material wealth and abstract value, but a radical reconfiguration of our relationships with one another and with our world.

Put differently, if capitalism initially took hold and spread in the fifteenth century owing to the logical relationship it established between abstract labor time expended and material wealth, which was what classical political economy claimed, then we can only move beyond this interdependence by practically freeing material wealth from labor and labor from material wealth. Yet, since our social relations, institutions, laws, and cultural forms are all grounded in and mediated by this dependence, it is easy for us to fall back into these familiar patterns whenever we are faced by economic crisis.

The result is that we are never quite able to fully restore autonomy and dignity to those spheres of life that under capitalism have assumed, at best, secondary roles. Thus, for example, freeing material wealth from abstract value could open up space for parents to spend more time with their children and take greater responsibility for bringing up their children. Touting “family values” from the campaign trail is one thing; implementing laws (such as the Family Leave Act) that create real space and time for families is quite another. We say that consumerism and shopping have come to dominate every corner of our lives. And, yet, we are reluctant to translate the unprecedented productivity of our capital into better funding for parks, recreation, museums, libraries, music, and the arts that could enrich all of us. “Think of the drag this funding would place on economic efficiency and productivity!” And, yet, that is precisely the point.

Or, to take another example, we often hear complaints that traditional values no longer play a central role in our public life. And, yet, we fail to draw the connection between this retreat of traditional values and the dominant role that abstract, exchange value has come to play. If the very logic of capitalism is driven forward by the dynamic relationship between material wealth and abstract value, and if it is the dynamism in this relationship that has forced traditional values from public and into private life, then there may be more than passing interest for religious practitioners to challenge the dominant position we have allotted to the relationship of material wealth to abstract exchange value.

(Oddly enough, Milton Friedman, the father of neoliberalism, set out a similar argument in the Introduction to his Capitalism and Freedom (1963). There Friedman argued that, given the pluralism of values in modern democratic societies, it was difficult to see how all of our competing interests could possibly not drive us toward civil war. Happily, Friedman argued, the free market solves this problem by reducing all of our most important relationships to market relationships. Lucky us.)

Religious practitioners often articulate this problem in oppositional terms, claiming that economic rationality and religious practice are, by definition, incompatible. That is not what I am claiming here. Rather, what I am suggesting is that, when economics turned its back on history and society or bracketed history and society, and elected instead to reduce economics (in the name of science) to mathematical modeling, it could not help but lose sight of the historical and social dimensions of its own science, which obviously include religion (and art, and education, and literature, and human relationships, etc.). But, rather than approaching economics and religion in an oppositional manner, what if we were to instead restore history and society to economic reflection?

Of course, this was precisely the sticking point for GFW Hegel and for Marx. It distinguished their way of thinking about economics from their French, British, and then Austrian and American counterparts. And it drove a wedge between the “scientific” approach to economics and the so-called “historical school.” Yet, as I have attempted to illustrate here, it is the latter, historical approach, that is better able to take up and consider the complex relationship between economics and those other dimensions of human life that we value. And this is because it enables us to reflect more critically on the ways that abstract value has come to dominate all other dimensions of our thought and practice.

But, if Marx offers us critical tools and perspectives that enable us to better understand the contemporary world, then why does Marx remain irrelevant to practicing economists? I am sorry, can you please operationalize that question?