Today in Urban Economics we covered a unit on housing allocation that dealt, in the main, with the market distortions introduced by rent control, rent subsidies, vouchers, public housing, and federal grants. The principal idea here is that when there is high demand for a private good — in this case housing — holding prices down (or, in the alternative, enhancing the capacity of renters to purchase that good) distorts markets, in fact exacerbating the misallocation of resources by discouraging owners from improving, developing, or, in some cases, even renting property, which would lead owners to operate at a loss. A corollary idea is that the housing market operates best when it is free from political interventions.

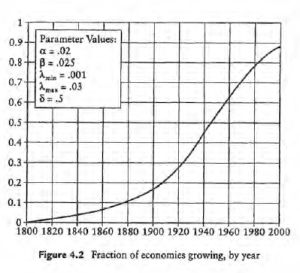

I then asked my students which of the following contributed most to the unregulated campaign coffers of those responsible for making and enforcing property laws: defense, agribusiness, big oil, labor, or real estate? Most of my 150 students thought that it must be defense, then oil, then labor, then agribusiness, with real estate and insurance coming last. I then splashed this slide on the screen taken from opensecrets.org.

By any measure you like, Finance/Insurance/Real Estate takes the cake, accounting for $693M in contributions to campaigns during the 2015-2016 election cycle. Second-place, “Other,” at $423M, does not even come close. What this means is that whatever the distortions introduced, it matters not from where or from whom, the marginal utility of these distortions to real estate is equal to or greater than $693M — so far. That’s what the real estate lobby feels its influence is worth, at the very least. Defense? Way down at thirteen.

Economics students always look sideways at me when I have them read excerpts from Aristotle’s Nicomachean Ethics and Politics at the beginning of every semester. Why would you have us read classical texts? What does this have to do with economics?

Listen. When Aristotle returned to Athens in the fourth century BCE under the protection of Alexander the Great (literally), he felt empowered to — well — speak truth to power. So, when identifying the “good” after which citizens would naturally strive — absent the constraints of coercion and necessity — he was quite clear that “making money” was not an end worthy of being identified as the “good” towards which citizens should strive.

The life of making money is a life people are, as it were, forced into, and wealth is clearly not the good we are seeking, since it is merely useful, for getting something else (Nicomachean Ethics 1096a).

The question Aristotle is raising — that we also are invited to raise — is under what conditions are we best able to make the best choices? There is no individual who, absent coercion, would answer that they are best able to decide under conditions of coercion or necessity.

Aristotle then flushes this answer out in his Politics where he shows why individuals skilled at business or familiar with labor would be the least qualified for citizenship. Both groups, Aristotle concludes, are, for similar reasons, constrained by necessity. Political decision-making, decisions not made for the sake of private self-interest, but for res publica — republican decisions — must be made in the absence of constraint.

So here is where the $693M paid to political decision-makers comes into play. Did they have to pay more, what would they pay, up to their margin? Since politicians can be bought off for pennies on the dollar, we may never know what their equilibrium market price actually is. What we do know is that there is a distortion in the housing market worth at least $693M.

I was reminded of this distortion today when I read the transcript of last night’s Presidential debate:

Trump: When you look at what’s happening in Mexico, a friend of mine who builds plants said it’s the eighth wonder of the world. They’re building some of the biggest plants anywhere in the world, some of the most sophisticated, some of the best plants. With the United States, as he said, not so much.

When invited to respond to where he made his money:

Trump: Well, for one thing — and before we start on that — my father gave me a very small loan in 1975, and I built it into a company that’s worth many, many billions of dollars, with some of the greatest assets in the world, and I say that only because that’s the kind of thinking that our country needs.

When invited to talk about his wealth:

Trump: I built an unbelievable company. Some of the greatest assets anywhere in the world, real estate assets anywhere in the world, beyond the United States, in Europe, lots of different places. It’s an unbelievable company.

But there were also seemingly meaningless asides in last night’s debate, when Mr Trump boasted of his assets in Chicago, or when he defended the practice of betting on market loss.

Trump: You need more police. You need a better community, you know, relation. You don’t have good community relations in Chicago. It’s terrible. I have property there. It’s terrible what’s going on in Chicago.

Clinton: Donald was one of the people who rooted for the housing crisis. He said, back in 2006, “Gee, I hope it does collapse, because then I can go in and buy some and make some money.” Well, it did collapse.

Trump: That’s called business, by the way.

In other words, the very qualities that Aristotle — the Father of Republican values — believed ought to eliminate a person from public service, Mr Trump counts attributes in his favor.

But, that is where we are, isn’t it? We live in a society where markets are horribly skewed against public interests (republican interests) in favor of private capital. Mr Trump is among those most responsible for market distortions. But instead of faulting him for his role, we laud him (and all businessmen and businesswomen). He represents the antithesis of public interest. And, yet, we do not fault him, but instead praise him for his hatred of the public. This is where we are.

The fact that close to 50 percent of the electorate agrees with Mr Trump is a severe indictment — an indictment at least as penetrating as Thucydides’ against Athens — against our ability to embody the ideals of our own Constitution, which, in large part, was modeled after Aristotle’s Politics. The fact that 50 percent of our voters admire a man who is the antithesis of these republican values is an indictment against us, all of us.