Last week a past Federal Reserve Governor, Daniel Tarullo, published a working paper, urging economists to develop a theory of inflation that governors on the Federal Open Market Committee (FOMC) could rely upon to set interest rates. While sympathetic with Governor Tarullo’s larger point, I do take issue with how he gets there, at least in part. The problem, as I see it, is not only that the what the FOMC does lends itself to being politicized. That goes without question. My more general objection is that, the decisions made by the FOMC are political — and rightly so. In what follows I want to suggest how we might recognize the fundamentally political nature of the FOMC’s job while protecting its members — and its decisions — from the kinds of political meddling from which Congress, rightly, wished to protect its decisions.

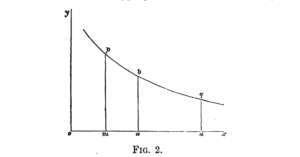

The US Congress has given the Federal Reserve a dual mandate: (1) to maintain employment at near “full employment” (however defined); and (2) to keep inflation in check. Its chief means for fulfilling this dual mandate is (1) easing or tightening the monetary supply; and (2) closely related, establishing the Federal Funds interest rate. In theory, these related mechanisms determine how ready investors are in the short term to part with — i.e., invest — their capital in assets that are more “fixed,” less “liquid.” So, for example, when the Fed lowers interest rates it means to encourage investors to invest their money in “fixed” assets that promise to offer higher returns than the interest rate on offer. But should the economy be expanding at a rate faster than investors can manage — i.e., when the overall effect of “easy money” is to raise prices and wages, not investments in fixed assets — the Fed will “cool” the economy down, usually by raising interest rates and tightening the monetary supply.

Last week Daniel K Tarullo, a former Fed governor, published a stunning admission. In a working paper titled “Monetary Policy without a Working Theory of Inflation,” the former Governor admitted “we do not, at present, have a theory of inflation dynamics that works sufficiently well to be of use for the business of real-time monetary policy-making” (2). Which means that, when he and the other governors met to set interest rates such that inflation could be maintained at the benchmark 2% — and when the governors meet today to do the same — they do not actually have a working theory for where they should set interest rates to achieve this goal.

“Not to worry,” you say. We know, roughly, that raising interest rates will tamp down inflation, and that lowering interest rates will — in the long run — fan the fires of inflation. Moreover, in light of its two fold mandate — employment and inflation — lowering interest rates under conditions of higher than desirable unemployment has the serendipitous consequence of bringing investors to invest in fixed assets that generate employment: a factory, a jet plane, a mine. Killing two birds with one stone, so to speak.

Yet, while they have contributed to a reduction in unemployment, over a decade of zero bound interest rates have not generated inflation at the target 2% rate desirable for a healthy, expanding economy. This, in turn, has led some to fear that raising the interest rate under conditions of inflation that are less than 2% will (1) discourage investment; and so (2) lead to higher unemployment.

One out of two isn’t bad. That’s fifty percent success. At least all of those unemployed folk will enjoy reasonably cheap prices; which, because they are unemployed, are still too high.

Overall, I found Governor Tarullo’s working paper stimulating. I agree (who doesn’t?) that the infamous Phillips Curve — which models the relationship between inflation and unemployment — is a less than perfect instrument. I also agree that the FOMC members are compelled to draw upon information for which there is no accounting in our existing models. Chiefly this information concerns what committee members feel future markets will look like and, therefore, how they will behave. Is the future brighter and rosier than the present? And, if so, does this information trigger a looser policy — to generate the growth I foresee? — or does it instead trigger a tighter policy — to put the breaks in advance on the overheated economy I foresee? Much will depend on how I read the tea leaves.

Governor Tarullo is troubled by these tea leaves, what he calls “unobservables.” I am not. Since interest rates are set to establish a general tendency toward some goal, not to hit that goal in an instant, I think that it is sufficient to take notice of where we are, where we have been, and where we want to be — how far are we from 2% — and work accordingly. I also think that the margins separating the judgments of one governor from another with respect to “(1) potential GDP growth, (2) the ‘natural rate’ of unemployment, and (3) the ‘neutral’ or ‘equilibrium’ rate of interest ” (4) are so modest as to warrant less weight than Governor Tarullo grants them.

Far more obscure — I agree with Governor Tarullo — is the crystal ball foretelling future market performance, because this performance is so dependent upon variables that do not fall under the jurisdiction of the Federal Reserve. In short, they are political.

Still, all politics are not the same. From 1945 to roughly 1971, all political actors were on roughly the same page, at least where the Federal Reserve was concerned. All of this changed over night when President Nixon took the dollar off the Gold Standard.

No. There is nothing magical about Gold. But, to what is the Dollar pegged if not to Gold? It is pegged, of course, to the total value of the goods and services in the economy. But, to what is the value of these goods and services pegged? To the Dollar.

The real significance of taking the Dollar off the Gold Standard was, in effect, to make the US and its economy a player in the global economy; not its standard; not its arbiter — but a player. More specifically, it allowed President Nixon to devalue the Dollar sufficiently (irrespective of its now irrelevant Gold value) to make US goods more affordable on the global market: things in the US became less expensive. US producers became — through this purely monetary vehicle — more productive.

Not that President Nixon needed the help; he buried his Democratic opponent, George McGovern, in a landslide in 1972. But, remembering the last time he had run, as the Vice President of a President who refused to take any action to expand the economy, President Nixon did not want to take any chances. In 1960, Nixon had lost by a hair’s breadth to Kennedy. Not again. Taking the Dollar off the Gold Standard was insurance; perhaps unnecessary, but useful nonetheless.

So, in 1971, the Federal Reserve was placed in the unenviable position, in the absence of Gold, of regulating the monetary policy for an economy that was not, in fact, growing; but was growing only on account of its recently liberated currency — liberated precisely for political reasons.

Absent actual economic expansion, but gifted with a now floating currency, Arthur Burns and then G William Miller struggled under untenable conditions. With Germany and Japan (since 1968) back at full industrial capacity, there was virtually no chance that the US — without a working national rail system, absent a single-payer universal health care system, without a viable universal educational system — would outcompete Germany or Japan on their own terms. Which is why Fed Chair Volcker had not choice but to put the beast out of its misery, raising interest rates almost twenty percent and, therein, putting an end to “stagflation.”

This political act, however necessary in fact, virtually guaranteed President Carter’s loss to Ronald Reagan in 1980.

Could anyone in the 1970s have predicted “stagflation”? Yes. And many did. Could anyone in the 1970s have predicted Chairman Volcker? No. But many hoped for his coming.

The business community is currently pining away for relief from taxes and regulations which are already among the least restrictive in the industrialized world. Where Japan’s and Germany’s productivity bumps have been grounded in — well — actual increases in productivity, US investors continue to rely upon federal assistance in the form of hand-outs from the bottom and middle to the top of the income hierarchy, shifts that hold absolutely no promise to increase productivity or growth, but only to increase the share of wealth owned by those in the top centile.

In this regulatory environment, is there any wonder, really, why inflation remains well below 2% while employment — or should we not say underemployment — has hit a twenty-five year low? Consumer purchasing power is completely stagnant. Full employment and below target inflation? If any one was wondering how, practically, to invalidate the Phillips Curve, this is how: send all of the efficiencies earned by working families to the top of the income hierarchy. That’s how.

This is politics, pure and simple. It was politics in 1971; it was politics in 1980; and it is politics today. Now, the goods news is that Chairwoman Yellin is as straight a shooter as anyone could want or find. The bad news is that under the current regulatory environment 2% is a completely unrealistic goal. Which is one of the reasons why I am still a bit confused by Governor Tarullo’s complaint.

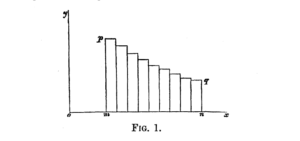

I actually think that, without too much effort, we could identify the coefficients Governor Tarullo is seeking. That is to say, I think that we could identify a set of variables, weighted differentially, that would allow us to account for the dramatic falling off of what Lord Keynes called the “propensity to consume.” The propensity to consume is not only a function of wages, but of wages relative to a stable currency and the value of goods on the market. Lord Keynes argued so many years ago that when wealth is bunched at the top of the income hierarchy, we might have an aggregate increase in wealth, but a much smaller growth in aggregate consumption: full employment, but stagnation.

Perhaps this was Governor Tarullo’s point; that we need to explicitly state and fold into our models what everyone already knows: that our productivity is being directed largely into the accounts of those who have the least propensity to consume. And this, of course, will dramatically dampen any inflationary pressures.

Lord Keynes invited us to speculate in another direction. What would happen if the efficiencies earned in the economy were spread out more broadly? And what if we then hit the wall of full employment?

Though the rentier would disappear, there would still be room, nevertheless, for enterprise and skill in the estimation of prospective yields about which opinions could differ. For the above relates primarily to the pure rate of interest apart from any allowance for risk and the like, and not to the gross yield of assets including the return in respect of risk. Thus unless the pure rate of interest were to be held at a negative figure, there would still be a positive yield to skilled investment in individual assets having a doubtful prospective yield. Provided there was some measurable unwillingness to undertake risk, there would also be a positive net yield from the aggregate of such assets over a period of time. But it is not unlikely that, in such circumstances, the eagerness to obtain a yield from doubtful investments might be such that they would show in the aggregate a negative net yield (General Theory, ch. 16).

Horrors! The disappearance of the rentier? Doubtful investments a negative net yield? Imagine!

We might — perhaps we should — imagine income inequality to maintain its upward climb, leveling off eventually as the rentier approach full command of all wealth. Such would not be an unrealistic assumption. In that case, we would be well-advised, as Governor Tarullo suggests, to scrap the unrealistic 2% goal for inflation; a goal which, after all, was based on a regulatory environment that now lies almost forty, and arguably sixty, years behind us. In that case, we would invite governors to hazard guesses grounded in the expectation of an expanding inferior goods market, with pockets of high tech, but with national wealth, by and large, invested in economies enjoying a more productive regulatory environment: India or Germany or, God forbid, France.

But, let us speculate, Lord Keynes-like. Let us suppose that, as in 1968 or 1971, there were a dramatic political shift where those in policy making positions suddenly focused on raising the fortunes of working families. Such is the kind of unpredictable future that Governor Tarullo imagines; where shifting policies give rise to shifting wealth and consumption patterns that invite us to rethink interest rates, employment, and inflation. What if, suddenly, wealth were to accrue to those who earned it, to working families? And what if, suddenly, their spending began to generate real economic growth, real wage growth, and real increases in prices and profits? Of course, relative to GDP, such increases, in and of themselves, would not be cause for alarm. Indeed, perhaps we would find ourselves precisely in that circumstance imagined by Lord Keynes at the end of Chapter 16, where, with the disappearance of the rentier and the lackluster returns on speculative ventures, growth, wages, and interest would find a sustainable equilibrium.

Ok. Pure speculation. Fantasy. Of course. But, now let us suppose that the Fed set as its goal not 2% inflation, but such interest rates as necessary sent efficiencies downward and outward: Yes. Negative interest rates that cost capital for hold it; cost capital for not investing it in economic growth.

Politics! Well, of course. Its all politics.