I have just delivered my last lecture in history of economic thought (ECON 105) for the summer. On August 22, the beginning of the fall semester, a new round will begin.

For the last lecture I make an effort to tie it all together, this time with the help of Giovani Arrighi. It seems impossible, but Arrighi’s Long Twentieth Century (originally published in 1994) is now over twenty-four years old. It still packs a punch. (Obviously did global markets — and, more to the point, incomes of working families — increase dramatically; did manufacturing return to the US; did the US Congress pass single-payer health care, high speed interurban and inner city light rail, Arrighi’s book would immediately be dated.)

The hardest nut to crack in this issue of ECON 105 is the last thirty years. In our penultimate seminar, we cover two theses: Robert J Gordon’s Rise and Fall of American Growth (2017), and Steven Teles and Brink Lindsey’s 2018 best-seller, The Captured Economy. Both books are well worth the read. Both directly address the post-1971 period of sluggish growth and the pitiful purchasing power of working families. In RJ Gordon’s view, it is a simple matter of innovation. We cannot imagine another innovation on the level of the networked home (electricity, water, refrigeration, communication, heat, and waste removal) or transportation (the combustion engine) that would, in so short a time, spread to every — literally every — household. In Teles and Lindsey’s book, the whole problem after 1971 is rent-seeking and capturing. One version of this story — that the political establishment, Democratic and Republican, sold the US economy to the highest bidder — strikes me as spot-on. The story Teles and Lindsey tell — that labor and capital each contributed to the captured economy? — not so much. Moreover, haven’t we suffered from rent-seeking from year one; the three-fifths clause, etc. etc.? To explain 1971-present, we need a more accurate instrument.

Which is why G Arrighi is so delightful! Delightfully wrong; but delightful! According to Arrighi (as CSN&Y once intoned), “we have all been here before.” To be precise, at least since the quattrocento, this is how capital has always behaved. Using paid mercenaries, Genoese merchants make a killing on “global” markets — which, in fact, for the fourteenth century were quite extensive. Their markets benefit all of the markets on their periphery: Portugal, Spain (and, through Spain, the Dutch), the Hapsburgs, the Swiss, southern France, and southern German lands. Everyone’s a winner. Gains from trade. Yada, yada.

But enhanced wealth leads to enhanced competition, leading two powers in particular — Spain and its Dutch colony — to wonder whether they could capture Genoese markets. The Dutch feel they are better situated and more attuned. They rebel against their Spanish overlords. At which point Genoese investors conclude: hey, they might be right. At which point, Genoese capital begins to flow into both Amsterdam and Spain, but mostly Amsterdam. Amsterdam wins (with Genoese assistance), kicks out the Spanish, and a new round ensues. Everyone begins to invest in the United Provinces’ enlarged trading empire. And everyone who does wins; but specially the French and the British, who each believe they could do better what the Dutch are doing. Investors — including Dutch investors — agree. And they all begin to invest in France and England, but mostly in England. France and England mix it up. England wins. Bang. Global empire.

Once again, everyone invests in England. There are gains from trade. In particular, the US and (a recently united) Germany gain from trade. In fact, each thinks it can outdo England. And, so, now everyone is competing for global markets. The Germans and the Americans go at it, not once, but twice; and twice the US wins, making America Great Again. The US establish an even broader, more dynamic, trading empire, made greater on account of the political liberties enjoyed by its trading partners. Yeah! The US system makes everyone great again. Eventually, however, Europe takes advantage of efficiencies — in health care, transportation, education, and leisure — that make its high tech, high end product lines more attractive than the United States’ heavily subsidized agriculture, oil and inferior goods markets. Global competition induces even US investors to shift their liquid assets to other markets around the globe. End game.

Its a riveting story — all except for the conclusion, wherein disenfranchised of the global north and global south throw off their chains, come together, hold hands, and sing “Kumbaya.” End of story. Or a fragmentation into warring factions. Or a successor hegemon: China? the EU? Russia?

With systemic ecological failure hanging over the whole mess.

Envelope please.

Here is my problem. From day one, in 1870, we have been driving home the production function, that ratio lying at the heart of every capitalist’s deepest dreams: more with less. It is the ground of competition: my ability — through cheaper labor, fewer benefits, better technology — to generate more value with less capital and less labor. The miracle of efficiency. This is not a pipe dream. It is what we are doing. Now. To generate efficiencies.

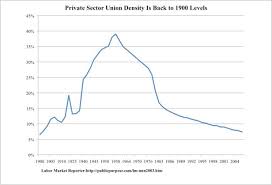

So what’s the problem? The problem is, we generate these efficiencies and then send them up to the tippy top of the income hierarchy, where they perform least efficiently. Other markets have elected to flatten the distribution of their market efficiencies. They have elected to create labor markets of highly skilled, healthy, and reasonably happy applicants. They have elected to create create political communities not easily swayed by fake news, where citizens enjoy a superior education, and where publics enjoy sufficient wealth not to be easily bribed. But they have also elected to create private markets in which players are not given incentives to rig the system in their favor. In these markets, it is not too difficult to imagine a different, less apocalyptic, more hopeful future.

This future cannot be realized without political action, but nor does it consist solely of politics. The efficiencies are already here. They simply need to be regulated differently. (The story that efficiencies distribute themselves is pure hogwash. Efficiencies follow courses set by law. Otherwise the Koch brothers would not attempt to change laws in order to distribute them differently.) An alternative distribution of efficiencies holds hope that apocalypse can be avoided, not because states have been abolished (or universalized), but because they have adopted republican ideals and democratic process. But reaching this outcome is only ever a possibility. Others besides this possibility offer themselves to us; mostly apocalyptic.

End of lecture. End of semester.