And I don’t want to hear anyone claiming that “nobody saw this coming.”

Within the next few weeks — less than a year — the bottom will drop out from under today’s inflated markets, making it likely that Congress will witness one of the largest shifts, from Republican to Democratic control, in modern history.

This is not, as some suspect, because markets cannot survive without aggregate consumer demand, or because transferring wealth to the top of the income hierarchy is inherently destabilizing. If the researches of Thomas Piketty and Emmanuel Saez have taught us nothing else, they have at least taught us that for 99.9 % of human history, wealth was happy to cluster at the top of the income hierarchy. Keep the peasants fed and drunk and you will be fine. A rebellion here and there; but nothing the police cannot handle.

Laws and regulations to ensure that wealth remains where it was produced are a twentieth century novelty. Admittedly, such a massive transfer of wealth from working families to investors as we are witnessing in the United States would, in Germany or France, lead to a general strike, massive protests, and regime change. But in the United States? Here it is the working families themselves to demand that their wealth be transferred to the top. Plutocracy is what they voted for; and its what they got . . . in spades!

And, yet, the peaceful streets and avenues, not to mention the prisons brimming with inmates, that meet us in the United States illustrate how it is possible to sustain an economy in the absence of effective demand. Trickle down actually works so long as enough trickles down. And when working families demand so little, “enough” turns out to be a very small amount indeed.

As I write, unemployment stands at a seventeen year low of roughly 4.5%, a product, almost in its entirety, of policies enacted by President Obama in spite of fierce Republican opposition. However, since current regulations reward investors for investing in speculative, high return instruments and punishes them for investing in high wage, secure jobs, the roughly 124M full-time workers are earning the same aggregate wage as the roughly 117M employed workers at the height of the recession. But that means that any consumption driving growth has arisen not from the effective demand of working families, but from the increasing wealth enjoyed by individuals perched at the top of the income hierarchy. Consumer demand among working families, since it is largely driven by debt (and the willingness and ability of lending institutions to sell debt to consumers), actually counts as an asset to investors, further widening the income gap. And, yet, if consumers fail to complain about their decreasing economic fortunes, or if they complain by electing policy makers from within the plutocracy, there is no reason why policy makers will enact policies that ensure that working families will enjoy the wealth generated by their efficiencies.

Plutocracy is sustainable, however, only so long as the public fails to use its power, or uses its power to elect plutocrats.

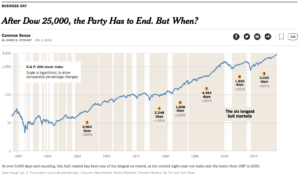

And, yet, we might wonder how long the speculative instruments into which investors are being encouraged to pour their wealth will retain their value. How much longer will these instruments offer returns greater than the returns investors might win from investing in secure, high paying jobs for working families?

Part, but only part, of this question rests on the ability of policy makers to craft regulations and laws whose effects are to transfer wealth from working families to investors. So, we can imagine any number of scenarios where revenues received by the IRS will be transferred to investors irrespective of the status of their investments. For example, let us say that I unwisely invest in petroleum simply because of the tax advantages I will enjoy from investing in dirty energy. And let us say that the bottom drops out of the petroleum market. So long as the Federal government will assume my losses and even reward me, irrespective of the performance of my capital, I will continue to bury my capital in dirty energy. The US Congress just passed a tax bill that handsomely rewards investors irrespective of the long-term performance of their investments; and that punishes working families irrespective of the efficiency of their labor. The legal regulatory regime implemented by policy makers thus makes a huge difference.

But then there is the trade deficit, which is currently pegged at roughly $50.5B, which means that we are not making any thing that any one elsewhere wants at the prices they are willing to pay. And it means that we are buying stuff produced elsewhere because it is being sold at a price we are willing to pay. Not to mention the $18.96T deficit to which the Republicans just added another $1.5T.

Remembering that debt is an asset (for those who own debt), it is clear that debt accelerates the transfer of wealth to the top of the income hierarchy — i.e., to creditors. Since this is so, we need to ask whether the debtors are good for their money. Will they pay up? And if not, what then is the value of their debt? A creditor who owns debt owed by a debtor unable to pay back his loan owns debt equal to or less than zero (less in the event that the creditor was relying upon that debt to purchase other assets). And it is this question that fuels speculation over when the bubble will burst; when will investors conclude that “there is nothing there, no value, nothing.”

That there is no value there is not a guess. It is a certainty. When the bubble will burst — tomorrow, next month, next fall — is a guess. But it is coming.