The Weekend Interview with Robert Lucas: Chicago Economics on Trial – WSJ.com

By now, nearly everyone has peaked at HJ Jenkins, Jr’s Wall Street Journal piece from this past weekend (09/24/11). But I am not sure that everyone has detected the Keynesian core of Lucas’s criticism of Paul Krugman.

Lucas, believe it or not, argues that there was not enough of a stimulus to convince investors to plow their capital back into production.

Did Lucas really say that? No. Not really. But, he came very close.

To be sure, the “reporter” Jenkins’ voice is at least as important in the article as Lucas’s, so it is more than a little difficult to separate the two.

Lucas’s advice reminds me of the high stakes, often fatal, game of chicken sometimes played by high school boys. Two drivers face one another two miles apart on a country road. They gun their engines and speed forward toward one another, in the same lane. The driver who flinches first loses. There are of course only one way for both players to win: if neither driver flinches.

Jenkins summary of Keynes is passable. “In a Keynesian world,” writes Jenkins, “when government gooses demand with a burst of deficit spending, the stick figures are supposed to get busy. Businesses are supposed to hire more and invest more. Consumers are supposed to consume more.”

“But,” he asks, “what if the stick figures don’t respond as the model prescribes?”

What if businesses react to what they see as a temporary and artificial burst in demand by working their existing workers and equipment harder—or by raising prices? What if businesses react to what they see as a temporary and artificial burst in demand by working their existing workers and equipment harder—or by raising prices? What if businesses and consumers respond to a public-sector borrowing binge by becoming fearful about the financial stability of government itself? What if they run out and join the tea party—the tea party being a real-world manifestation of consumers and employers not behaving in the presence of stimulus the way the Keynesian model says they should?

Perhaps this is just the WSJ doing what the WSJ does best, editorializing what it mistakes to be the news. But, let us assume for the moment that Jenkins is actually channeling Lucas. What then? Is there anything here (save the final sentence) that is not Keynesian at its core?

If capital is not convinced that there is a real opportunity for long-term economic growth, then it is not going to take the bait. Right? And if capital is convinced that it can make higher returns on financial markets than on capital goods, then there is no reason why they should trust that a trickle of G-change will turn the economy around. Right? And, so, the logical, rational, problem is to figure out what will induce investors to plow their capital back into capital goods and jobs. Right?

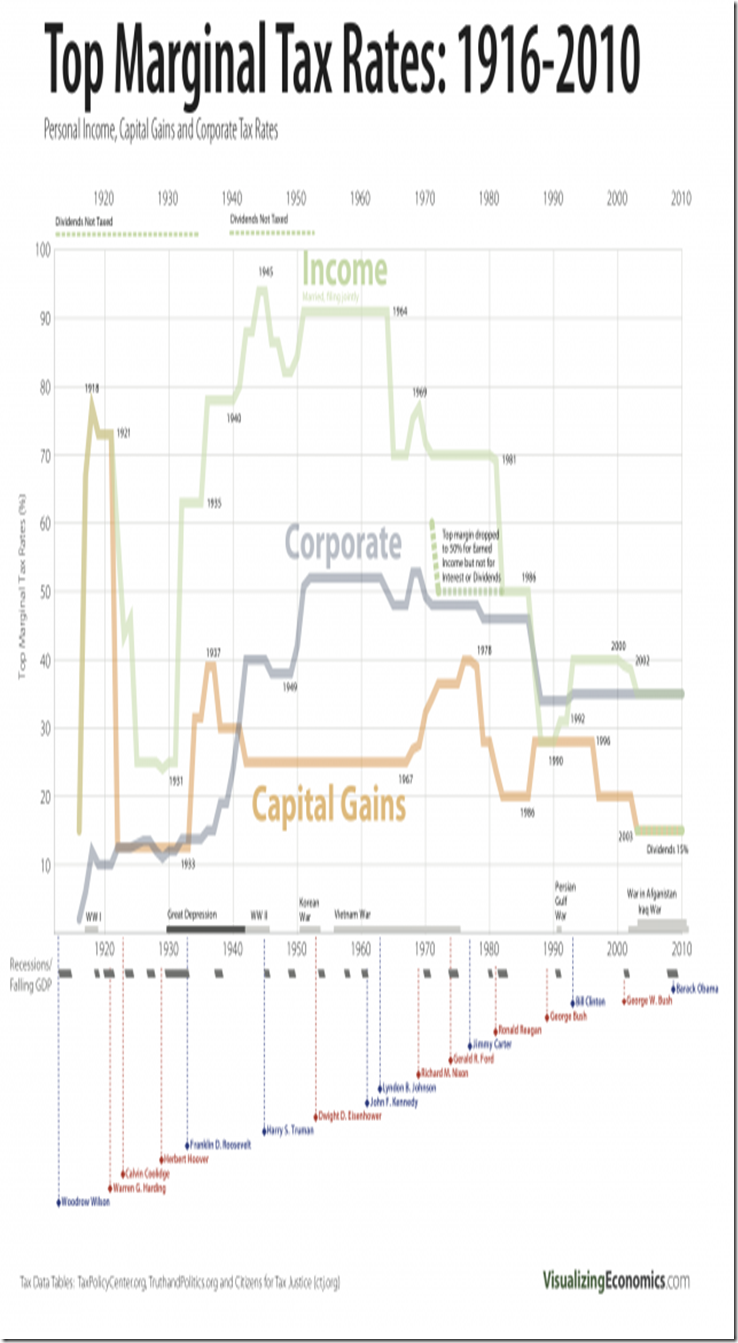

But, it is precisely here that Jenkins loses track of his own Keynesian argument and falls back into the mantra of every WSJ reporter mistakes for thoughtful reflection: lower taxes on capital. And, yet, based on corporate tax and economic growth rates data, this clearly cannot be the answer. For, as Lucas himself helped to show, if taxes and economic growth are related, they are related in ways that are neither directly causal nor simple.

Even Lucas’s most damning condemnation—“I was caught by surprise by how far left the guy is and how much he’s hung onto it and, I would say, at considerable cost to his own standing”—turns out to have been leveled not against President Obama’s stimulus, which Lucas supported, but against investments in capital goods that do not have, nor are likely to have, a market. As Lucas himself puts it, “If you’ve overbuilt something, that’s not the problem, that’s the solution in a way. It’s too bad but it’s not a make-or-break issue, the housing bubble.”

His real criticism—did any of you get it?—is that Obama has no plan for convincing investors to invest capital in capital goods, jobs, and consumer goods. Obama, in other words, is insufficiently Keynesian. Rather than take the heat for a bold economic initiative, “the president keeps focusing on transitory things. He grudgingly says, ‘OK, we’ll keep the Bush tax cuts on for a couple years.’ That’s just the wrong thing to say. What I care about is what’s the tax rate going to be when my project begins to bear fruit?”

But, here, Lucas reveals his own unfounded bias. For the only investor who is concerned about the tax rate down the road is an investor who lacks a product that will command sufficient returns. What Lucas cares about, in other words, is not the returns on his investment, but the tax on his investment. He is still thinking under the presumption of liquidity for the indefinite future.

The question we might ask is whether there is any rate of return on investment, however large, that Lucas (or Jenkins) would feel warranted the rates of taxation that industry enjoyed in the 1950s and 1960s, decades when investors were enjoying such handsome returns on their investments? If the answer is that there is no rate of return on investment that would warrant these rates of taxation, then Lucas is admitting that there is nothing that would provoke investors to plow their liquid assets back into capital goods, jobs, and consumer goods, absolutely nothing.

In which case, either investors are irrational or they believe that they can get even more by indefinitely subjecting the public to this dangerous game of chicken.

Comments are closed.